Managing financial goals can be a challenging task for anyone attempting to save money. Despite starting with the best intentions, unforeseen expenses or a sudden reduction in income can easily derail one’s plans. As a result, achieving financial goals can seem like an overwhelming and complex endeavor.

To address this challenge, Goalry was developed to help individuals stay on track with their personal finance objectives. This user-friendly financial planning platform simplifies the process of setting smart financial goals and monitoring progress over time. Additionally, the platform allows users to modify their plans easily as their financial needs and goals evolve. Ultimately, Goalry helps individuals manage their finances more effectively, making it easier to achieve their long-term financial objectives.

What is Goalry?

Goalry is a user-friendly financial planning platform that helps individuals set and achieve their financial goals. It provides a comprehensive set of tools and resources to manage personal finance objectives effectively. The platform allows users to set smart financial goals, track their progress over time, and adjust their plans as needed. It also offers educational resources to help users improve their financial literacy and make informed decisions about their money. Overall, Goalry aims to simplify the process of financial planning and help individuals achieve their long-term financial objectives.

How does Goalry work?

Goalry works by providing users with a range of tools and resources to help them set, track, and achieve their financial goals. Here is a general overview of how it works:

Set financial goals: Users start by setting specific financial goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund. The platform offers a range of tools and calculators to help users determine how much they need to save and how long it will take to reach their goals.

Create a plan: Once users have set their financial goals, they can create a plan to achieve them. The platform provides guidance on how to create a realistic plan that takes into account their income, expenses, and other financial obligations.

Track progress: Goalry helps users track their progress toward their financial goals. It provides a dashboard that shows users how much they have saved, how much they still need to save, and how long it will take to reach their goals.

Adjust plans: As users' financial situations change, Goalry allows them to adjust their plans accordingly. For example, if they receive a windfall, they can update their plan to reflect the new income.

Access educational resources: In addition to financial planning tools, Goalry provides educational resources to help users improve their financial literacy. These resources include articles, videos, and other content that cover a wide range of personal finance topics.Overall, Goalry provides a comprehensive platform for individuals to set and achieve their financial goals, offering both planning tools and educational resources to help users make informed decisions about their money.

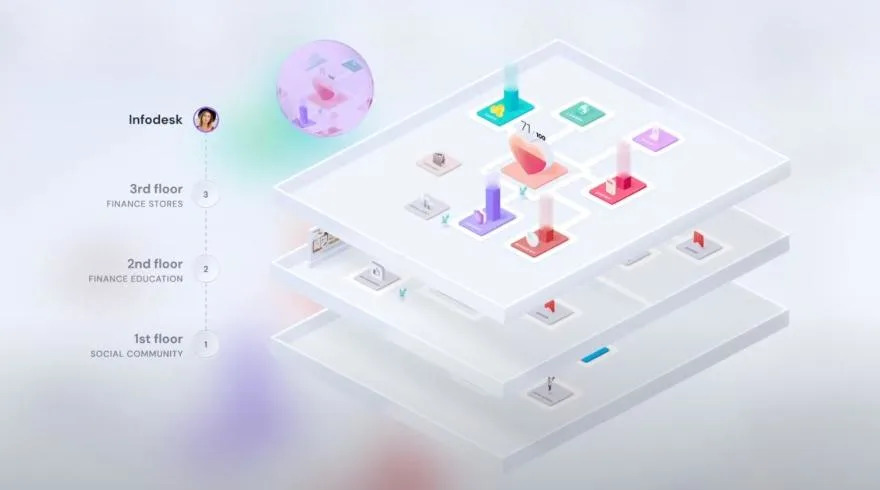

Infodesk

The fourth floor of Goalry’s Money Mall houses the Infodesk, which is a 3D map of the Money Mall and has information on how to navigate the platform.

Finance stores

The entire third floor of the Goalry Mall is devoted to finance stores. There are 11 different stores on the floor, each specializing in a particular type of financial goal. These include a savings store, an investment store, a debt reduction store, a wealth-building store, and more.

We go into more detail about each store below.

Finance education

The second floor of the Money Mall is devoted to financial education. You can browse through 2,000 published articles and 400 videos to learn how to manage your money. The platform also offers 30-second solutions to address frequently asked questions and guide users toward more in-depth answers.

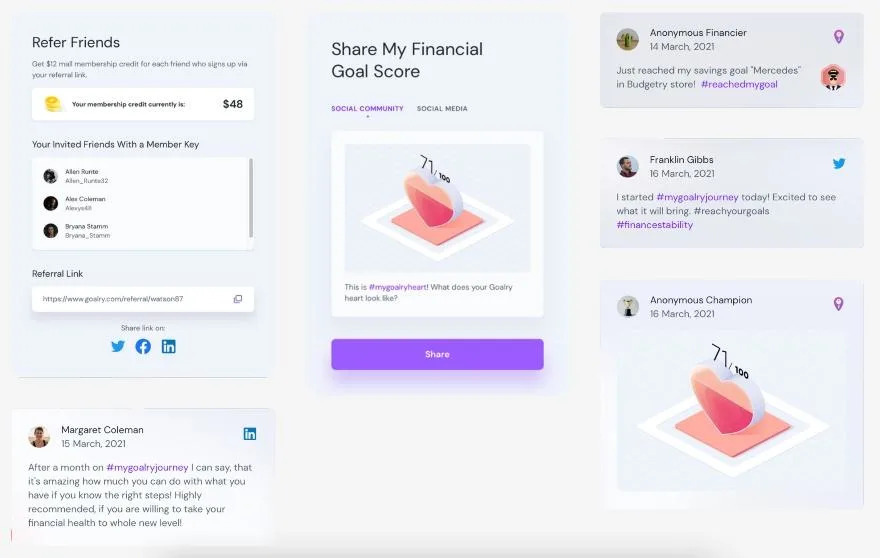

Social community

The first floor of the Money Mall community is dedicated to like-minded people working toward financial goals. You can connect with other users by posting on the platform’s private social media network to share your financial journey and stay accountable.

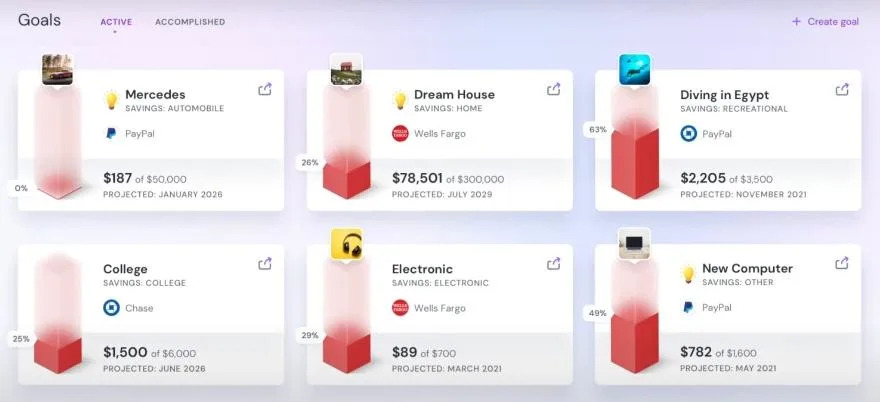

Goals

Goalry’s Goals tab allows you to see any of the financial goals you set in other stores on one page. View your savings goals for trips and high-ticket items, or see how far you’ve gotten on paying down each of your credit cards. You can even set new goals straight from the Goals tab rather than visiting a specific store first.

Here are a few goals Goalry has already set up for new users:

- Get Property Value: Find out how much your home or investment property is worth. The tool will provide you with an estimated value based on recent sales data in your area.

- Maximize Property Value: Get access to detailed appraisals from top-rated real estate professionals to help you maximize the value of your property.

- Budget Better: Track your expenses and improve your money management skills. You’ll also get personalized tips to help you improve your spending habits and create a budget that fits your needs.

- Save Money: Create a savings plan and monitor your progress with Goalry’s budgeting tools. Whether you’re trying to build an emergency fund or save for a down payment on a house, Goalry can help you reach your goals.

- Get Out of Debt: Access the tools and resources you need to start tackling your debt and working toward a debt-free life.

- Manage Taxes: Stay on top of your taxes and plan for future tax payments with Goalry’s tax tools. Get help from accountants and tax professionals, or manage your taxes yourself.

- Wealth Building: Learn about different investment strategies and find the right one for you with Goalry’s wealth-building resources.

- Get Emergency Cash: Access top lenders and find the best emergency cash options for your financial needs.

- Manage Credit: Understand how credit works and how your credit card usage and financial decisions can impact your credit rating. Get access to credit monitoring tools and personalized advice on how to improve your credit score.

- Compare Insurance: Access a database of the best insurance providers and find affordable coverage for everything from health and dental to life insurance. Compare different plans and get the coverage you need for yourself and your family.

- Shop for a Loan: Get pre-qualified for a loan and compare offers from multiple lenders with Goalry’s loan shopping tool. Find the rates and terms for your needs and get advice on how to choose the right loan for you.

How finance stores work

Goalry offers a number of “stores” or financial tools to help you take control of these major financial areas in your life.

- Billry: With Billry, you can receive and pay your personal bills, like utilities and credit cards, in one place to help you prioritize your bills. Billry also lets you connect to multiple financial accounts so you can track all of your finances within the platform.

- Budgetry: Create a budget in minutes and get insights into your spending habits month after month. This tool helps you create a spending plan that you can stick to and make better financial decisions for your future.

- Cashry: Cashry, all of your incoming and outgoing cash flows are automatically recorded so that you always know exactly how much money is available in your connected accounts.

- Creditry: You can use Creditry to check your credit score, monitor suspicious activity that could harm your credit and identity, and get personalized advice on how to improve your credit score.

- Debtry: Debtry lets you create a debt reduction plan, track your progress, and get tips and advice from financial experts.

- Insurry: Whether you’re looking for car insurance, life insurance, or health insurance, Insurry can help you compare insurance and find the best coverage at the most competitive prices.

- Loanry: Loanry will connect you with the best lenders and help you find ones with competitive rates and terms that align with your financial goals.

- Taxry: Taxry provides a number of tools to help you with your taxes. These include a number of tax calculators and a list of tax preparation software and firms you can filter and sort based on your needs.

- Wealthry: Whether you need a tool for managing your finances, comparing investment accounts, or finding an advisor who can help you manage your portfolio, Wealthry offers multiple resources for all things investing.

- Accury: Get an accurate value of properties and detailed property reports along with tips for maximizing your equity with Accury.

- Blockry: Blockry lets you manage your finances using blockchain technology. You can safely organize, track, or trade digital assets and even get notified of fraudulent activity.

Who is Goalry best for?

Goalry is best suited for individuals who are looking to manage their personal finances more effectively and achieve their financial goals. It can be particularly helpful for those who are just starting to get a handle on their finances, as well as for those who are facing complex financial situations.

Some examples of individuals who may benefit from using Goalry include:

Individuals who are looking to save for a specific financial goal, such as a down payment on a house, a child's education, or retirement.

Individuals who are dealing with debt and are looking for a plan to pay it off.

Freelancers, entrepreneurs, and other self-employed individuals who need to manage irregular income and expenses.

Anyone who wants to improve their financial literacy and make informed decisions about their money.

Individuals who are struggling to manage their finances and are looking for a comprehensive platform to help them get on track.Overall, Goalry is a useful tool for anyone who wants to take control of their finances and work towards their long-term financial goals.

How to get started with Goalry

- Sign up for an account. To use Goalry, you’ll first need to sign up for a membership and get your member key which allows you to unlock your account.

- Select your goals. Once you have access to your member account, you can start setting your financial goals. You will probably use more than one Goalry store to help organize your financial data and track your financial goals.

- Select your plan. After you’ve selected your goals, you’ll need to choose a plan that best suits your needs.

Goalry pricing

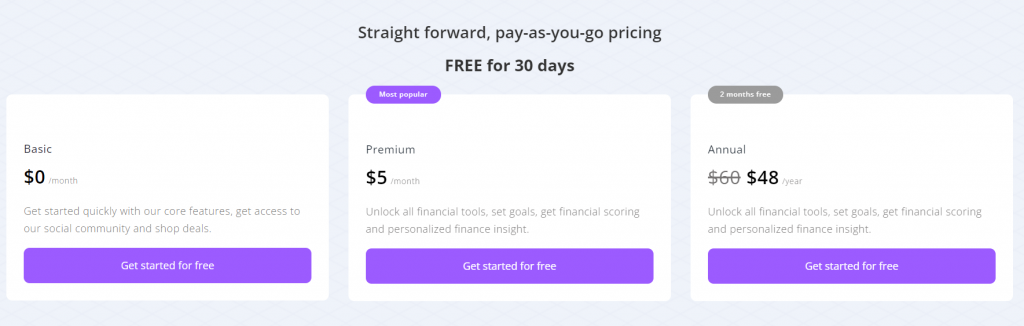

There are three different membership plans to choose from: Basic, Premium, and Annual. You can only use the free Basic plan until you add a bank account. This activates your 30-day free trial of Premium, after which you will need to pay.

Bottom line

Goalry is intended to reduce the burden and stress of having to manage your financial goals in multiple places. Taking advantage of the platform’s resources could help you achieve your money goals more easily.

Having a system in place for monitoring your financial progress can help you stay motivated, focused, and on track. Sign up for Goalry or look through these budgeting apps to find a tool to help you achieve your financial goals today.